Comcast has deployed upstream-enhancing "mid-split" upgrades to 35% of its hybrid fiber/coax (HFC) network and is on track to expand that to 50% by the end of 2024, execs said on today's Q4 2023 earnings call.

Those mid-splits, which expand the swath of spectrum dedicated to the upstream to a range of 5MHz-85MHz (versus a legacy range of 5MHz-45MHz), are being used today to boost upstream speeds in some markets. It's also a component of Comcast's DOCSIS 4.0 network upgrade, which paves the way for symmetrical multi-gigabit speeds. Comcast has launched D4.0 – under its new "X-Class" Internet brand – in parts of three markets: Atlanta; Colorado Springs, Colorado; and Philadelphia.

The general idea behind the upgrades is to ensure that Comcast's HFC network capacity remains speed-competitive with fiber and to stay well ahead of customer data usage demands. But, for the moment, those upgrades are not driving broadband subscriber growth.

Broadband losses stabilize

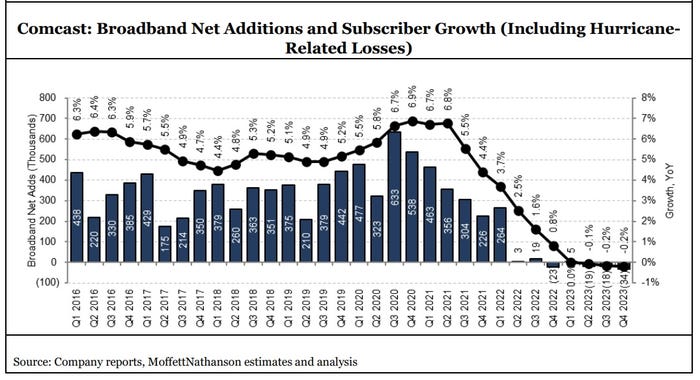

Comcast's broadband subscriber losses stabilized in Q4 – the company lost 34,000 overall, including -31,000 residential and -3,000 business customers, lowering its grand total to 32.25 million (29.74 residential and 2.5 million business). Analysts were expecting Comcast to lose 62,000 broadband subs. Comcast shares were up 4% in mid-day trading Thursday.

"Comcast's YoY broadband subscriber growth has been below zero for three straight quarters – in Q4 it remained steady at -0.2% – but the pattern defies the fears of an implosion that many bears have feared," MoffettNathanson analyst Craig Moffett explained in a research note (registration required) issued after Comcast's Q4 call.

Meanwhile, broadband average revenue per user (ARPU), now considered by Comcast as the key metric for its broadband business to be judged upon, rose 3.9%.

Dave Watson, CEO of Comcast Cable, said the macro trends in broadband are relatively unchanged amid sluggish housing movement, near record-level low churn and an "extremely competitive" broadband services market.

On the competitive front, Comcast is feeling the pinch primarily from fixed wireless access (FWA) services that are having success at the lower end of the broadband market.

Comcast isn't predicting when broadband subscriber growth will again turn positive.

"While we do not expect subscriber trends to improve in the coming quarters, we do expect them to improve over time," Watson said.

One area in broadband where Comcast is growing is network expansion. Comcast said it exceeded its goal by passing 1.1 million new homes and businesses in 2023. The plan is to replicate – and possibly improve upon – that pace in 2024.

But some analysts see that strategy as a stabilizer rather than a source of subscriber growth. "Faster homes passed growth won't turn broadband subscribership back into a growth engine, but it should go a long way towards keeping results stable," Moffett noted.

Eyes on BEAD and the ACP

The bulk of Comcast's network expansion is self-funded, save for some money it's received from programs such as the American Rescue Plan Act (ARPA). Comcast will also participate in the $42.45 billion Broadband Equity Access and Deployment (BEAD) program, which will help to bring broadband to more underserved and unserved areas. But the company doesn't expect to see much benefit from BEAD until 2025.

"The process, quite frankly, is still in flux," Watson said of BEAD.

Watson said Comcast is already preparing for a potential shut down of the Affordable Connectivity Program (ACP), a subsidy program that is set to run out of money this spring unless the government agrees to refund it.

Comcast has about 1.4 million ACP recipients, but the majority of them were Comcast customers prior to the program. Comcast is already reaching out to them about alternatives to ACP, including its own low-cost program, Internet Essentials. Comcast is "well positioned" if ACP is not refunded, Watson said.

Analysts seem to agree that it's not much of an issue for the operator. "We think ACP is not material for Comcast, though a loss of ACP may still cloud subscriber trends when it ends sometime in late 1Q24 or early 2Q24," New Street Research analyst Jonathan Chaplin said in a research note.

Update: Scaling to a model New Street used to estimate the risk Charter Communications faces if ACP goes away (about 260,000 subs and $900 million in revenues at risk)), Chaplin said in a follow-up note that Comcast's risk is in the neighborhood of approximately 80,000 subs and $250 million in revenues.

Mobile pace slows

Comcast's Xfinity Mobile business saw gains in the quarter, but the pace of growth slowed.

Comcast added 310,000 mobile lines in Q4, up 24% year-over-year, but off from a year-ago gain of +365,000. Analysts were expecting Comcast to add about 342,000 mobile lines in Q4.

"I think we can improve on these results," Watson said of Xfinity Mobile's subscriber tally in the quarter.

Comcast ended the period with 6.58 million mobile lines, representing 11% penetration of its domestic residential broadband subscriber base. Comcast pulled in $1.02 billion in wireless revenues in Q4, the first time it has eclipsed the $1 million mark in a quarter.

Though Comcast has not been as aggressive with mobile promotions as Charter Communications has, it continues to experiment with offers. Earlier this month, for example, Xfinity Mobile and Comcast Business Mobile began to offer a new Samsung Galaxy S24 128GB smartphone "on us" with an eligible trade-in if they pre-order the device before January 30. Comcast is also offering up to $500 off on new Galaxy phones during that pre-order period to customers who are using a trade-in.

Pay-TV losses, Peacock gains

Comcast shed another 389,000 pay-TV subs, dropping its total to 14.1 million. Analysts were expecting Comcast to lose about 458,000.

Under NBCUniversal, Peacock added 3 million paid subs, expanding its base to 31 million, and an ARPU of $10.

NBCU has yet to report any specific Peacock subscriber gains – or churn numbers – in the wake of its exclusive stream (local TV markets being the exception) of the NFL Wild Card game between the Miami Dolphins and Kansas City Chiefs on January 13. The game drew an average audience of about 23 million viewers across Peacock, NBC stations in Miami and Kansas City and on mobile via NFL+.

Comcast and NBCU are pleased with the result, but they think the NFL game stream is just one piece of a larger puzzle for Peacock.

"What's important is to keep people engaged with the platform – all of the content that's there – not the Wild Card game unto itself," Comcast President Mike Cavanagh said. "The job is to get more people in the door and get everybody that's already in the door to reengage with the platform."

Peacock's EBITDA loss for full 2023 was $2.7 billion. Comcast expects 2023 to represent the peak year of losses for the streaming service.

"network" - Google News

January 26, 2024 at 01:45AM

https://ift.tt/MKaNm09

Comcast advances on 'mid-split' network upgrades - Comcast advances on 'mid-split' network upgrades - Light Reading

"network" - Google News

https://ift.tt/h7zb53S

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment